Can the Degen Speak?

Green Candle Brain Disease rules us. What comes first the narrative or the Green Candle?

A meme coin grows 100x. Suddenly, the timeline is filled with proclamations of this Cycle being an era of the meme. What came first: the Green Candle or the narrative?

What if it’s not just shilling? What if the Green Candles actually speak through us? Put another way, are we simply following a rollercoaster ride where free will is limited?

Green Candle Brain Disease (GBDC) is a diagnosis for this condition. The green candle happens before the narrative. Your free will is limited. The narrative is merely the brain attempting to tell a story about what has already happened on the chart. The Twitter timeline is a secondary effect.

I am going to propose a framework around GCBD that I have found helpful in understanding crypto. It’s going to seem obvious because it is obvious. However, the implications of it and the operation of it are distinct from how we often think about crypto behaviors.

Crypto Market Dynamics (aka Behavorial Economic Structures of Control)

Consider the broader global economy, the ebbs and flows of it have various markers and dynamics. It feels impossible to control outside of small impacts, predictions, beliefs around long term trends or global scenarios. The idea of the market as a kind of god is reoccurring. Although we know it is a sum of human behavior, there is a tendency to treat it as unruly, uncontrollable, beyond our individual will. These are all somewhat basic challenges or tensions within mainstream economic thought.

We often have a similar belief system in crypto despite the pool of participants being far smaller. We know the patterns: after a BTC halving this happens, during the bull market that happens, when an ATH occurs there is X% growth over so many days. These things feel like uncontrollable patterns despite the fact that we often are directly witnessing the day to day activities of the ~1M+ people that drive the market. There are a number of ways to explain why this is the case.

Rather than debate economic theories on why this arises, let’s simply assume that there are patterns to what occurs here. And those patterns can be measured and observed with some level of consistency. This will establish the ground layer for the Green Candle Brain Disease thesis.

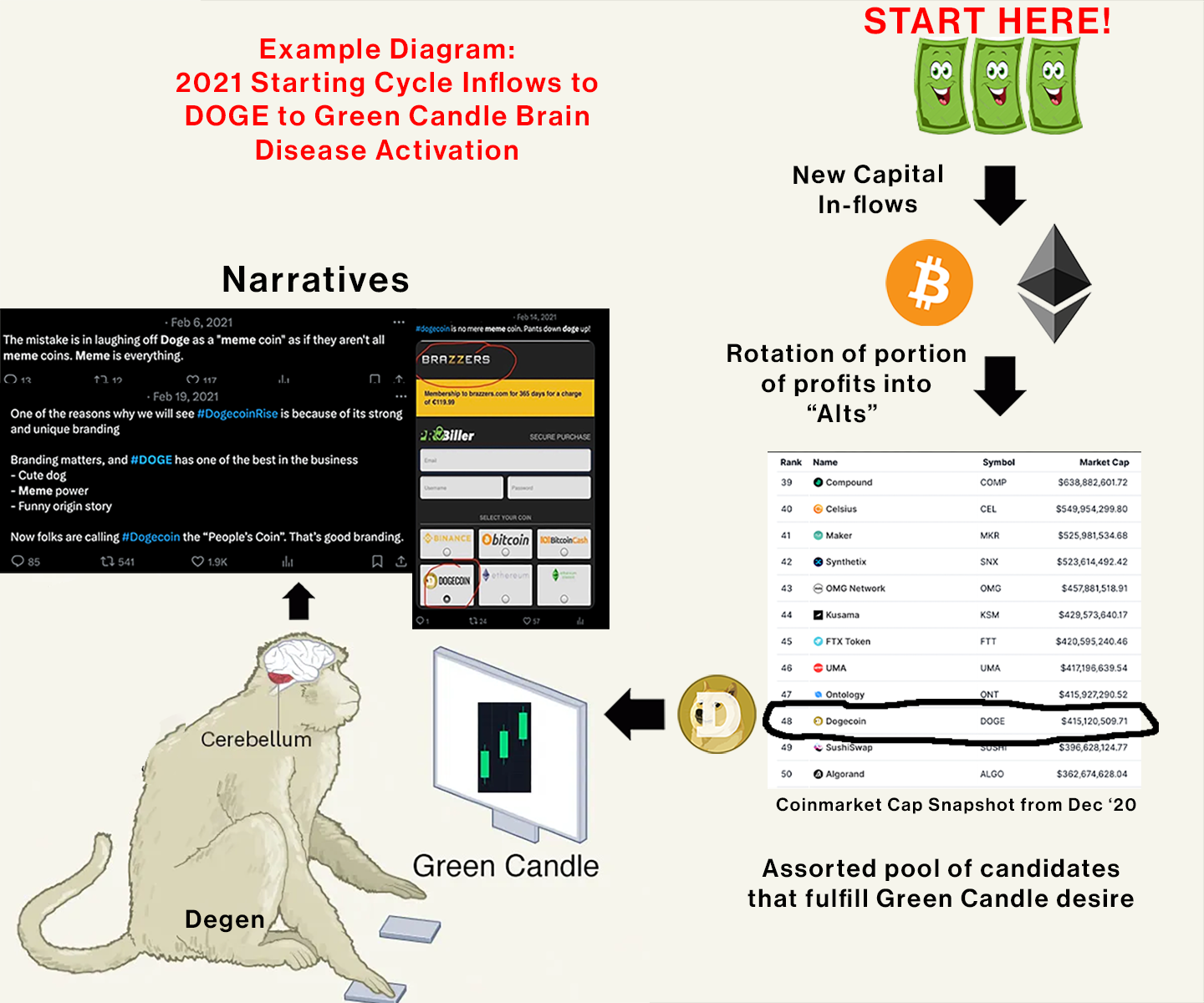

Let’s look at a recent case study: DOGE in 2021.

2021 Memecoin Case Study

It’s 2021. The Cycle is kicking up. Bitcoin and Ethereum are ramping in value, new capital inflows are becoming consistent…

Let’s take a look at what happened to DOGE.

BTC starts moving up in Dec ‘20

BTC accelerates into Jan ‘21 and then has a small pullback

DOGE sees significant growth during BTC pullback (20x vs June ‘20)

BTC begins ramp with choppiness into peak from April to June

DOGE has spike towards the end of BTC peak in May / June (220x)

DOGE slow decline for balance of Cycle

If you recall this moment, you may start thinking of various narratives surrounding why DOGE picked up… It was memetics! It was fun! It had a strong culture! Elon Musk tweeted about it!

However, what’s interesting is that a majority of the narrative about “why DOGE” occurred in mid February. The actual run up on price of DOGE had started in January and had largely stabilized by the first week of February. Is this a cabal? Is this simply influencers shilling their bags?

Sure, I think you can claim any of these things. Before coming to some of the conclusions in this writing, if I asked myself “why did DOGE go up so much in 2021,” I would start to think about: memes, attention, accessibility, trader cultures, and influencers pushing it.

This would miss, however, the key thing that enabled DOGE to run in 2021: being the closest available Green Candle at a moment of market euphoria.

Capital Flows & Green Candles

Let’s go back to a framework that many of us in crypto know: the BTC —> ETH —> Alt rotation.

The rotation is the description of the flows of capital from BTC to other coins that typically occurs during a crypto economic “Cycle.” What it describes is something behaviorally straight forward: investment flows into the largest most established asset first (BTC) and then to increasingly smaller and more risky assets next.

I won’t go into proving this in detail, but there are plenty of places to go see the supporting data that this seems to occur consistently thus far.

Let’s see how this works in 2021 with our DOGE example.

Notice how small the purple line is? DOGE printed a huge candle and tremendous returns as we recall from our earlier chart. However, the actual dollars needed to drive that outcome were small. $2B in real capital entered DOGE from Jan to Feb, but almost $100B had entered into BTC/ETH at that point in time.

Market psychology has flaws and often is not true to life, but it can form a helpful story about what’s going on here.

You are a degen, you’ve been overexposed to crypto throughout the bear market. New capital begins flowing in and it’s sustained for a couple months. The market is excited about Bitcoin again, your 2 BTC and 1 ETH portfolio more than doubled in size. You’ve seen this before and know it’s going to be a big year.

You take some profits and decide to rotate it into alts… You won’t rotate a lot, just a couple thousand dollars… maybe 5% of your profits. It’s fun, why not buy a lottery ticket?

What actually has the potential to drive a big green candle and print a 20x return in short order? What’s a fun throwaway thing to bet a little money on with your newfound wealth?

Fulfilling a Desire for Big Green Candle: Capital’s Requirements Early in the Cycle

If you want a big Green Candle, a crypto token needs to fit criteria like:

Relatively small marketcap

Has dynamics that lead to rapid price volatility (upwards preferably of course)

Able to be traded by a wide population of crypto natives (who also just received a crypto cycle stimulus check)

What had all of these criteria? DOGE in 2021.

Market cap in Dec ‘20: $0.35B

First $2B of capital inflows raised the marketcap to $8B in a week (~20x vs Dec )

Next $10B of capital inflows raised the marketcap to $50B in two weeks (~140x vs Dec)

Can be traded with ubiquity

And the criteria that doesn’t really matter? Foundations, sustainability, long term viability, meaning. You’re trying to have fun, look for a big win in the casino.

We considered the psychology of this from the perspective of a degen, but now consider it from the perspective of capital with a goal of being productive, driving short term growth. One hundred billion dollars enters crypto for the first time in a while — it’s been a long bear. Why wouldn’t some of it leak into a smaller cap where it can instantly accelerate it? Especially in a moment where BTC and ETH is correcting or taking a moment to breathe.

There are only so many choices of where this capital goes that fulfills our criteria above. And this criteria isn’t a permanent one. It is what is desired in euphoria, where the long bear has thawed and new found money has hit old wallets.

Capital flows before thought, creating GCBD

Capital only needs the attributes of size, impact of inflows, and ubiquity to drive the outcome it desires. The choice of which coin fills this role is arbitrary. That is why this is not a trading exercise.

This understanding won’t tell you what coin to buy. It will simply tell you what behavioral economic regions are likely to stimulate the Green Candle. And from the Green Candle comes Green Candle Brain Disease — the sudden utterance of narratives explaining what has already happened.

This is just one example, but I find it helpful to follow the thread with DOGE from end to end. What’s also interesting is that the other coins that fulfilled similar short term roles had similar movements at different parts of the cycle (some to disastrous outcomes).

The narratives explaining why DOGE went up ignore the reality that a significantly broader set of coins actually went up with similar fervor that shared no narrative similarities. The underlying similarity is a market cap size, ubiquity and ability to print a green candle.

I should clarify that the DOGE example is an extreme. The beginning of the cycle desires the most short term extreme green candle without a sustaining logic. Later in the cycle, we see the emergence of more complicated, sustaining, and opportunity for more thought. That is to say the flows of capital become more mature.

However, foundationally, the same Green Candle Brain Disease phenomenon occurs where the narratives discussing these things are occurring AFTER they print their green candles. And I think it’s important to establish that these are not simply shills for bags.

I’m not the first to formulate this, in many ways traders have some of these core principles embedded in their intuition.

2024 Near Term Implications

There is much more to consider here that I won’t get to here, but it will be an area of continued investigation. I think the important part here is to reframe how we read, interpret and discuss what is happening in crypto.

When the Twitter TL is overwhelmed with narratives — whether right or wrong — we can use this to better understand when GCBD has taken control.

Here are the implications I think most relevant now as of March 2024:

Do not assume that the narratives about meme coins, attention and so on are what is driving them

Do not build a long term assessment of the space or the future of the space based on Green Candle Brain Disease generated narratives

Know that the flow of capital looks for the most short term locations early in the cycle but matures later

To draw our parallels to 2021, let’s look briefly at WIF, PEPE, and DOGE. Again, recall the narratives we are currently seeing. Is it really true that WIF is the future of memes and Solana is the chain of the future? Or is it the case that WIF had more potential to satisfy a big green candle than DOGE or even PEPE?

This is made even more extreme when we think about scenarios that fragment capital and enable even larger green candles. BOME is an excellent example of this. The secret sauce of BOME?

The BOME liquidity pool was so small compared to the demand that only $40M in net purchases (capital in flows) was required to bring it to $1.4B market cap. Yes, that is one of the most efficient “green candles” one can imagine. And yes, that is only possible as a short term blip because what goes up $1.4B in a day driven by only $40M must (at some point, perhaps) come down.

And again, remember, it’s not that BOME was special. It is that BOME was ready to receive capital and print a big green candle in a short term way. More capital actually flowed to plenty of other things (including PEPE), but the narrative forms around the Green Candle.

Conclusion

There is a lot to dive into here that I still need to work up. And in some ways this can make the space seem hopeless. The optimism of this framework, however, is to know that the flows will continue. What is “true” now of the space will not be true in another several months. There will be good things funded alongside the dumbest possible things. And it’s okay to have fun with the dumb things as well of course.

This moment will pass and another movement of capital will occur. The entirety of the 2024 cycle will not be dominated by memes or shitcoins. We are simply feeling the reverberations of capital flows entering the degen’s brainstem and forcing them to speak.

truly increzibool

interesting piece. imo tho i think narrative and price are like "the chicken or the egg" dilemma, not necessarily one thing always comes first. many narratives are built and formed for many years (for example real yield), and saying price always drives narratives disregard all the efforts of builders that turn those narratives into reality. but in the example of memes, what you are saying is very true. great piece!