The 2021-2023 NFT Retrospective - Chapter 1: Users & Scale

Chapter 1/4 in a deep analysis of the '21-'23 NFT cycle and what we can learn for the future

Preface

I started this work almost 8 months ago to analyze and come to terms with the rollercoaster of ‘21-’23 for NFTs. I published two longform Twitter threads that covered some of the analysis in this document.

I had assumed that a large number of projects would start to lose steam and being able to assess what narratives had failed as well as what the future might entail would be timely alongside that. Well, after 8 months of waiting, we have finally gotten through the slow decline of ‘21 era NFTs.

The decline in confidence in BAYC (standard bearer for the ‘21 cycle) together with other recent news has led me to dust off this work.

The goal here is twofold:

To learn from the good, bad, and ugly of ‘21

To point towards the potential of NFTs in ‘24 and beyond

There will be a total of four chapters that I will release over this week. The chapters are as follows:

Users & Scale: ~650K users spent $6.5B on NFT mints

Trapped in a Casino: The majority of users & funds never leave crypto

Mausoleum for a Burned Ape: IP narratives dominated with glimmers of hope for Art

Against the Mainstream: A new path for “NFTs” in ‘24 and beyond

Chapter 1: Users & Scale

Get ready, this one is mostly data and charts.

The adoption curve is a critical concept. We often think about going “mainstream” with NFTs, but I would ask us to take pause and reflect on where we actually are in adoption.

What we will find is that the population of users actually buying and selling NFTs was relatively small indicating that we are still in the very early innings for this market. And not only that, but the users themselves, have a tremendous buying power.

Let’s take a look at what happened in the NFT market with a focus on the total amount of money spent on NFTs as well as the total number of users.

Let's get grounded on some key facts:

$6.5B was spent on minting ETH NFTs between 2021 to 2023

$1.5B was collected via royalties and marketplace fees

That’s a huge number. While the trading volume is also an interesting metric, I think it’s important to get grounded on how much money we know directly went from users to projects, owners, and platforms. Volume can make you think that, perhaps, high frequency or washtrading exaggerated the size of the NFT market, but true mint and marketplace fees give us a good handle on money that went out of users hands.

How many users actually participated in the market then during this time?

"Users" as a metric in crypto is typically fraught. We know it's easy to spin up new wallets, and metrics can be inflated. We are seeing this more than ever in 2024 with airdrop farming, DAU inflation and more.

The real question, however, is a more approximate one: Is it a million people? Five million? Half a million? If the number is in the tens of millions, we are likely in an early adopter mode. If it’s in the 1-3 millions, we are probably in the “innovator” phase of adoption.

As a starting methodology, we use a simple segmentation to first see how many individual wallets exist that bought or sold (traded) NFTs 3 or more times from 2021 to 2023.

The output of that work is a single number: 2.1M wallets. Now we have a cap, there are AT MOST 2.1M users.

How do I know those ~2M wallets are really users though?

We can look at Ethereum's monthly average wallets and compare to how many non-zero wallets there are. Over the last 2.5 years, the cumulative number of non-zero wallets doubled while "true users" is likely about flat.

If we apply that logic to the NFT wallets... We should likely cut our 2M NFT wallets number in half to get to a rough sense of "users". So now we have a maximum of ~1M NFT users over the last 2.5 years.

Of course, this starts to beg more questions… What is a user? What if someone quits? Who is really active?

There are two numbers that are important: 1) Total unique users reached 2) Weekly active usage Let's take a look at weekly active usage of NFTs. Unfortunately, our best usage metric is “has bought or sold NFTs in last week”... For most of 2022, there were about 250K weekly wallets.

While there is more nuance, I think 250K is a good general "bottom end" of the user number. Sure, there could be bots and multiple wallets, but 250K weekly usage during a sustained period of time feels like a good number of real active users at a minimum.

Alright, so where do we land? There are between 250K to 1.0M unique users who participated in ETH NFTs.

For short hand going forward, we will cut it somewhere in the middle and say there are ~650K users. 650K souls trapped in the Crypto Casino of NFTs.

Now, we will pressure test our spend number and see if it makes sense.

$6.5B on mint fees across 650K users.

~$10,000 spent per person on mint fees.

Seems like a ton right? Well maybe. Let's go deep on this.

How do we think about liquidity entering a market? And who GETS the money in the end? Where did the $6.5B of mint fees "go?" And how do we think about the slow illiquid nature of NFTs?

$10K per person seems like a lot for individuals to spend on minting NFTs. And we know the $6.5B number is a fact. So how do we deal with it?

Let's define WHERE money has the opportunity to leave the market.

Minting: theoretically spent on "operating costs" / taken out of market

Royalties: same as above

Marketplace fees: theoretically spent on operating costs of the marketplace

Gas fees

Traders who exit

We will take a deeper look at number 5 later. We will also skip gas fees as it's not interesting for our needs. So let's dig into 1-3. Since all of these are based on market conditions, let's start by looking at the timeline of volume for the NFT market...

Dollar value of NFT volume on ETH L1 was $44B over the last 2.5 years

2021: $17B 2022: $23B 2023: $4B (thru 6/13)

So, first check... if $6.5B was spent on mint fees alone, does it make sense that the volume could be 6-7x that? Maybe! Let's look at a few other things...

So I go back to our pie chart... $6.5B in mint fees $1.5B in royalties and marketplace fees $8B that was definitely spent.

But what if some of the $6.5B in mints are spent back into the market? Really, does that make sense?

Well... Nansen did great work on tracking what happened to NFT mint proceeds both in 2021 and 2022. What we see is actually surprising... And it's a sign of behavioral patterns we will revisit later. Here's where the money went in 2021 (through August)

In H1 2021, 18% of the money definitively went back into NFTs. Okay that's something, but take a look at this... In H2 2022, a full 50% of mint fees were put back into the NFT market DIRECTLY.

Let's pause here for a minute. 50% of the mint funds from projects were used to buy MORE NFTs. Some of that is likely bad behaviors (inflating your own project’s floor etc). However we should really digest this: Over only 6 months of time 50% of project funds got degened back into the market.

So back to our quest to see how much money was really there to be spent... I'm going to take a leap and assume that this 50% will hold for all project funds and over most of the peak of the NFT boom from the middle of 2021 to end of 2022.

Remember projects took in a total of $7.3B in mint fees and royalties: 2021: $2.1B 2022: $4.4B 2023: $0.8B If 50% is "spent back" into the market... and then marketplaces take $0.7B... Then the true liquidity "leaving" is roughly $4.4B.

So our 650K people spent a ton of ETH trading back and forth, but at the end of the day $4.4B showed up and was purchased... without just being "recycled." Is that real? Did these people show up with this money and put it into the NFT vending machine?

Well let's just look at their wallets... probably should have done this first!

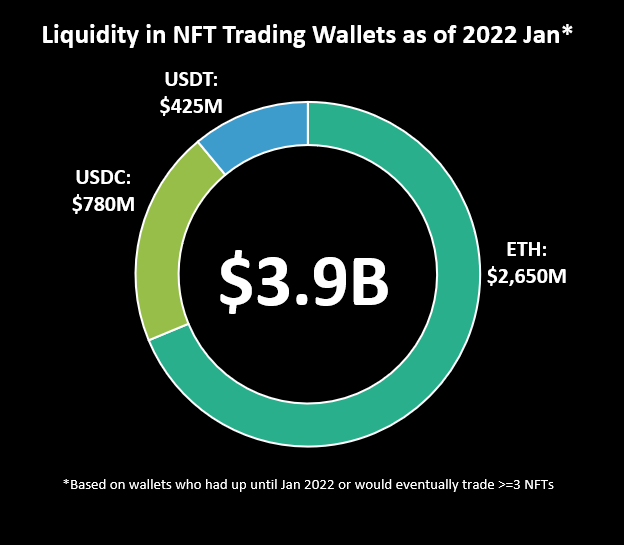

The wallets that satisfied our criteria (were active NFT traders) had over $3.9B in LIQUID assets IN their wallet in Jan 2022. This is ONLY looking at USDC/T and ETH.

So, what have we established?

There are likely 650K users who have participated in ETH NFTs. There was $6.5B spent on mints and $1.5B on secondary fees. Of that, projects dumped 50%(!) back into buying more NFTs.

Closing

This chapter is technical, but important as it frames a lot of the key metrics that we will continue to come back to.

The next chapter is below: “Trapped in a Casino” where we will find that users rarely leave crypto and that a very small number of users make up a majority of the heavy volume.